Please enable JavaScript to use the website of the Tokyo Metropolitan Government.

Main content starts here.

Financial Structure of Local Governments in Japan

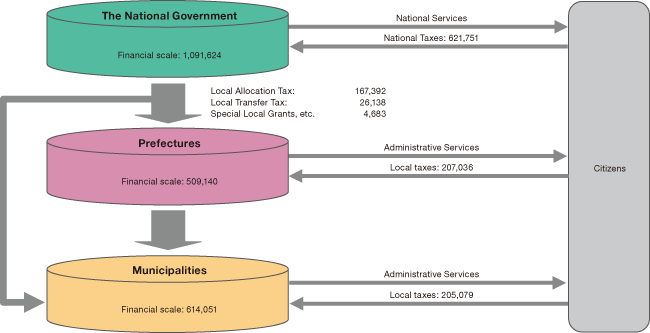

The administrative system of Japan has a three-tiered structure: the top tier is the national government, and below that are the two tiers of local governments—prefectures and municipalities.

With the exception of administrative functions such as foreign relations and national defense, most of the administrative functions are financed both by the national government and local governments. Many of the national policies and programs are carried out by local governments.

In fiscal 2019, net total expenditure by the national government and local governments amounted to 73.4201 trillion yen and 98.8467 trillion yen, respectively. The scale of expenditure by local governments reached approximately 1.3 times that of the national government; this figure shows how extensive a role local governments play in the public administration of Japan.

The total amount of tax collected in fiscal 2019 was 103.3866 trillion yen, of which national taxes accounted for 60.1% and local taxes, 39.9%. However, the ultimate allocation of this revenue was 41.0% to the national government and 59.0% to the local governments. This is because about 30% of the taxes collected as national tax are distributed to local governments through systems such as the local allocation taxes, local transfer taxes, special grants to local governments, etc.

Structure of Local Public Finance in Japan (Unit: ¥100 million, FY2019)

Revenue

Looking at the breakdown of revenue for local governments (FY2019), local taxes made up the largest proportion at 39.9%, followed by local allocation tax (16.2%), national treasury disbursements (15.3%), and local bonds (10.5%). In more detail, the sources of revenue for local governments are as follows:

Local Taxes

These are collected by local governments, and are the key source of revenue to carry out policies that meet local needs.

Local Transfer Taxes

Local transfer taxes are national taxes of which a fixed proportion of revenue collected is transferred to the local governments. Local transfer tax is an umbrella term covering taxes such as the local gasoline, special tonnage, petroleum and gas, automobile weight, aircraft fuel, and special corporate transfer taxes.

Local Allocation Taxes

These taxes form the core of the local financial adjustment system of the nation. The system is designed to sustain general revenue sources and to correct fiscal imbalance among local governments, thereby ensuring that all local governments are able to provide an adequate level of services. This general revenue source consists of grants to local governments calculated by a fixed formula, which allocates a percentage of revenues collected nationally. The percentage of revenue allocated to local governments is 33.1% of income tax, 50% of liquor tax, 33.1% of corporation tax, 20.8% of consumption tax, and 100% of local corporation tax.

National Treasury Disbursements

These include allotments disbursed by the national government to local governments on the basis of the cost allotment classifications of the national government and local governments; mandatory cost sharing; consignment costs; and subsidies for the promotion of specific policies and support for public finances.

Local Bonds

This is revenue from bonds issued by local governments to defray the cost of constructing public facilities such as roads and schools. These are costs that should be spread over a number of years to have generations of residents benefitting from their construction share the burden equally.

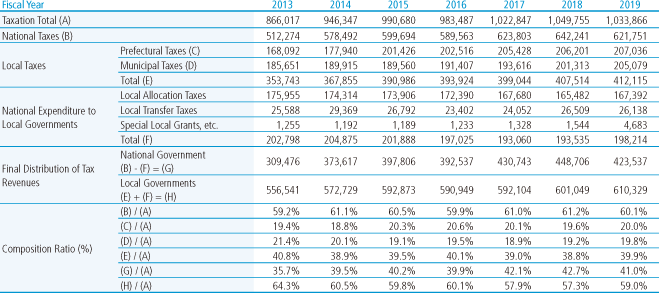

Distribution of Taxes (Unit: ¥100 million)

Note 1: Total figures may not equal the sum of components due to rounding.

Expenditure

The breakdown of local finance expenditure by administrative category during fiscal 2019 shows social welfare accounting for 26.6%, followed by education at 17.6%, and civil engineering works at 12.2%, with social welfare and education combined amounting to about 40% of total expenditure.

The main items of expenditure of local governments are as follows:

Social Welfare

This expenditure provides social welfare services, including the development and operation of welfare facilities for children, the elderly, and people with disabilities, and serves to implement programs to provide public assistance, among others.

Public Health and Sanitation

The purpose of this expenditure is to maintain and promote the health of residents and improve the living environment. Funds go to carry out various medical policies, public health and mental health programs, sewage treatment, refuse collection and disposal, and measures to control pollution.

Agriculture, Forestry, and Fisheries

The purpose of this expenditure is to promote agriculture, forestry, and fisheries, and to maintain a stable supply of foods. Funds go to develop the production infrastructure, improve the industrial structure, take measures related to consumption and distribution, and develop and promote agricultural, forestry, and fisheries technologies.

Commerce and Industry

This expenditure is for the promotion of local commerce and industry, and to help companies update and streamline operations. Funds go to guide and develop small and medium-sized enterprises, to attract companies to local areas, and to carry out consumption and distribution measures, among others.

Civil Engineering Works

This expenditure is for development of the local living environment and urban infrastructure. Funds go to construct, develop, and maintain public facilities such as roads, rivers, housing, and parks.

Education

Education is one of the basic administrative areas of local governments. Expenditure is made toward furthering education and culture through schools and social education programs.

Debt Services

This expenditure is made for the redemption of capital and interest from the issue of local bonds.