Please enable JavaScript to use the website of the Tokyo Metropolitan Government.

Main content starts here.

Tokyo's Finances

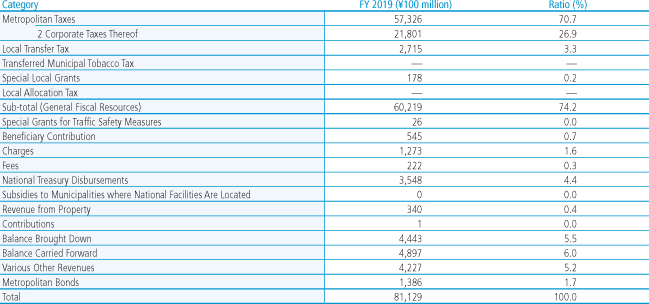

Revenue

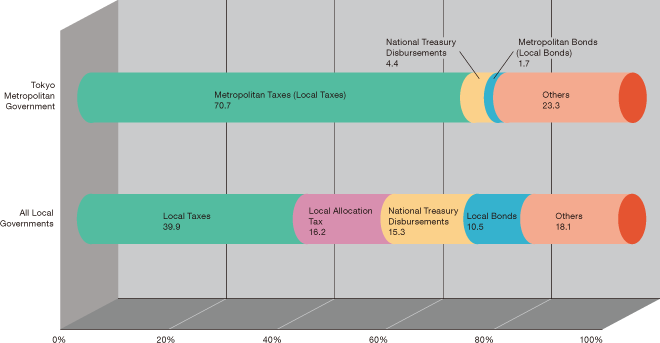

Metropolitan taxes provided for 70.7% of the settled account for metropolitan revenue in fiscal 2019. In light of the fact that local taxes accounted for just 39.9% of the total combined revenue of all local governments in fiscal 2019, the significantly large share held by local taxes in Tokyo's revenues is a major feature of metropolitan finances.

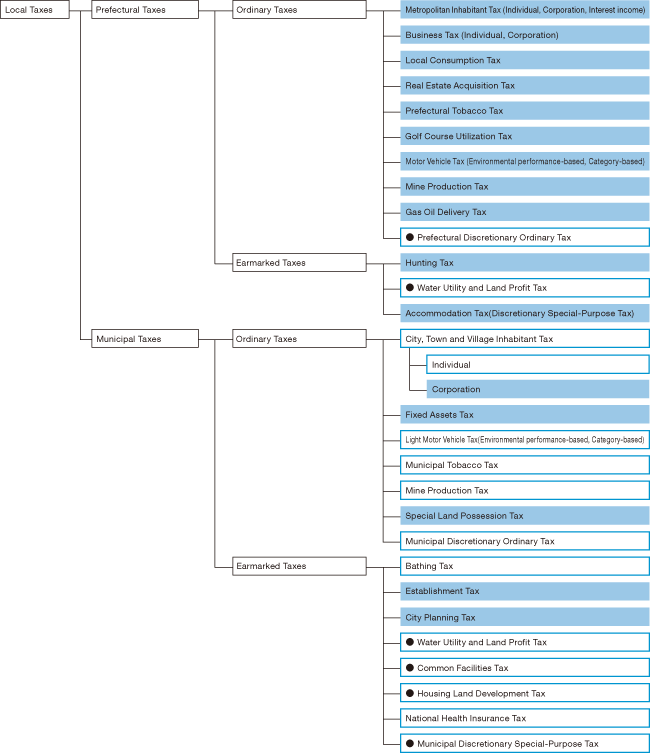

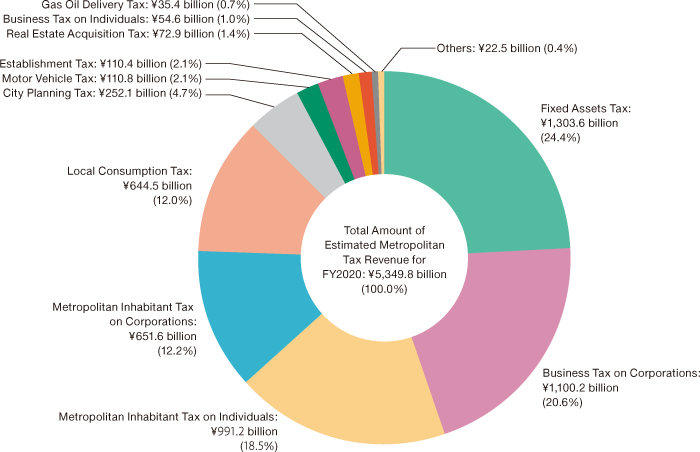

The metropolitan government levies 16 of the local taxes listed in the Local Tax System chart below. The largest proportion of total metropolitan tax revenue in fiscal 2019 came from the two corporate taxes of Corporate Enterprise Tax and Corporate Inhabitant Tax (approximately 38.0%). This is followed by the fixed Assets Tax and the City Planning Tax (approximately 26.8%) There are several items taxed directly by the metropolitan government in the 23 special wards, which in other prefectures are not levied by the prefectural authority but rather come under municipal taxes. This is because Tokyo provides services such as fire fighting and sewerage in the ward area, which would generally be carried out by the municipality. The government thus levies these taxes to allocate funds to pay for these operations, with 55% of tax revenue obtained from three taxes—Municipal Inhabitant Tax on Corporations, the Fixed Assets Tax, and the Special Land Ownership Tax—allocated to each of the wards to provide them with their own financial resources.

National treasury disbursements hold a smaller share in overall metropolitan revenue than in that of other local governments. National treasury disbursements accounted for 15.3% of total local government finances in fiscal 2019, while it accounted for only 4.4% of metropolitan finances in fiscal 2019.

Metropolitan bonds constitute an important financial resource for infrastructure development and urban renewal. To avoid a future increase of financial burdens, the metropolitan government is endeavoring to refrain from any undue reliance upon the flotation of metropolitan bonds, and to contain them within an appropriate degree.

Details of Tokyo Metropolitan Government Revenue

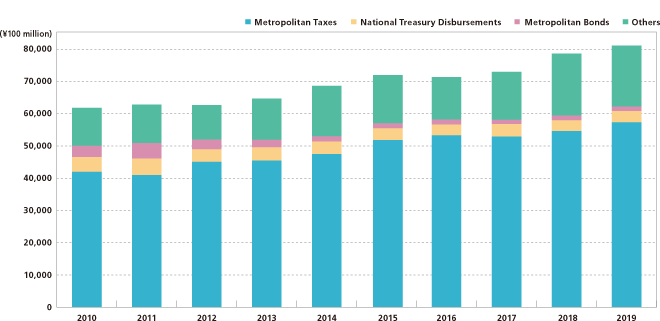

Details and Trends of Tokyo Metropolitan Government Revenue

Comparison of Revenue Breakdown

Tokyo Metropolitan Government: FY2019 Settlement of Accounts

All Local Governments: FY2019 Settlement of Accounts

Local Tax System (As of April 1, 2021)

Note 1: Municipal taxes in the sky blue box are metropolitan taxes in the 23 special wards.

● indicates that the tax is not levied in Tokyo Metropolis.

Note 2: Special Land Possession Tax has been suspended since fiscal 2003.

Breakdown of Metropolitan Tax Revenue for FY2020 (composition ratio)

Note 1: Figures shown have been rounded off. The total amount of the estimated tax revenue may not agree with the sum of the individual taxes.

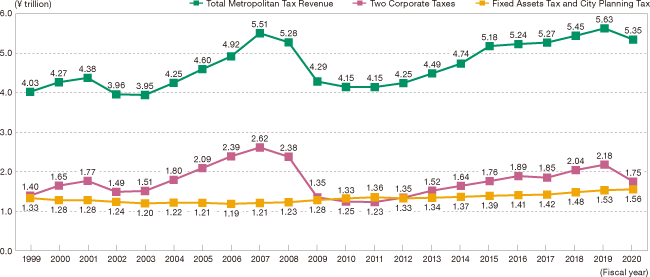

Metropolitan Tax Revenue Trends (1999–2020)

Expenditure

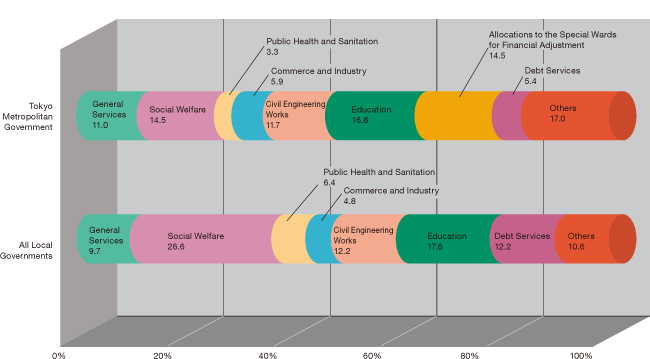

The expenditure of the metropolitan government has significant differences from the expenditure of other local authorities. First, the government is responsible not only for the administration at a prefectural level but also for part of the administration in the ward area, which elsewhere would be carried out at the municipal level.

Another important difference is the special ward financial adjustment allocations, an expenditure item found only in Tokyo. The special ward financial adjustment system aims to have financial resources related to the metropolitan administration fairly distributed between the metropolitan government and the 23 special wards, as well as to correct the imbalances between the 23 special wards in their fiscal strengths and ensure that they can provide an adequate level of public services.

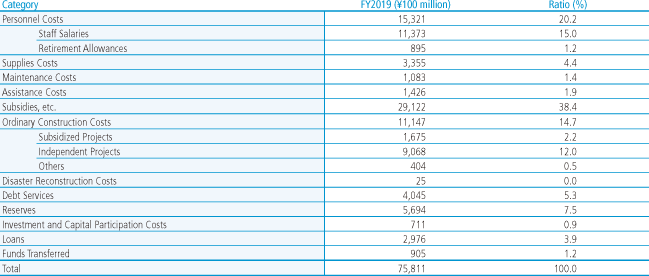

When expenditure is viewed by type, personnel expenses constituted approximately 20% of total expenditure in fiscal 2019; the majority of this is the staff salaries of the police and fire departments, schools and other personnel directly concerned with the lives of Tokyo's residents. Ordinary construction costs accounted for about 10% of total expenditure. These are the costs to build social infrastructure such as roads and bridges, and facilities including schools and social welfare facilities. In addition, subsidies and other expenditures, which include allocations to the special wards for financial adjustments and subsidies for facility operation costs, also made up a large proportion.

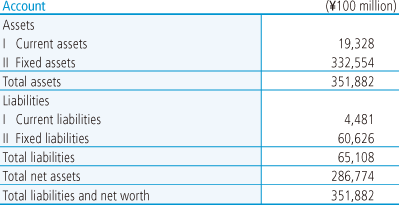

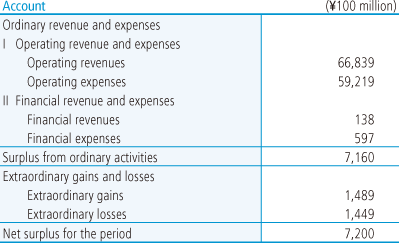

Introduction of a New Public Accounting System

Adding to the existing cash-basis accounting system, which corresponds to the budget system, in FY2006 the Tokyo Metropolitan Government (TMG) established double-entry bookkeeping and accrual-basis accounting standards that take into consideration characteristics particular to public administration. This was a first in Japan. Based on this financial accounting system unique to the metropolitan government, financial statements prepared in accordance with corporate accounting practices are released in the TMG Annual Financial Statements and other mediums.

(1) Balance Sheet (FY2019)

(2) Statement of Operating Costs (FY2019)

Challenges Facing Metropolitan Finances

Japan's economy is still in a severe state due to the impacts of the COVID-19 pandemic. When considering the risk of further economic downtrends in Japan and overseas from the infection situation, and fluctuations in the money and capital markets, future prospects for the economy are uncertain.

Metropolitan tax revenues form the core of Tokyo's revenues, and a large share of those tax revenues comes from corporations. This makes the fiscal structure an unstable one that is easily swayed by economic trends. In addition, as the FY 2019 amendment to the tax system included a new measure to redistribute corporation tax revenues, it is expected that Tokyo will continue to face a severe fiscal climate.

However, despite this situation, the Tokyo government today must not only properly deal with pressing issues such as COVID-19, but steadily move ahead with measures to build an environment where everyone can feel safe and play a vibrant role in society. These include preparing for disasters such as heavy rain and large earthquakes, responding to the issue of a declining and graying population, resolving the issue of children waitlisted for daycare, and supporting the empowerment of women.

At the same time, measures that will lead to the sustainable growth of not just Tokyo, but all of Japan, must be aggressively implemented while also considering the SDGs and sustainable recovery. These include polishing up Tokyo's “earning potential” such as by realizing the vision of Global Financial City: Tokyo and boosting entrepreneurship and innovation, and realizing Zero Emission Tokyo and taking climate action.

It is also important to promote initiatives to create a new society, such as enriching the lives of citizens and raising productivity by accelerating digitalization under public-private partnership, in addition to advancing the structural reform of Tokyo with an eye to the future beyond COVID-19.

Against this backdrop, the Tokyo Metropolitan Government will steadily realize the measures raised in Future Tokyo: Tokyo's Long Term Strategy, and make good use of ideas that think out of the administrative box; advance structural reform of the Tokyo Metropolitan Government based on the basic concepts for reform and reform practices raised in the “New Tokyo Government” strategy to raise the quality of services provided by the metropolitan government; and use ingenuity for wise spending while, among others, thoroughly reducing wasteful spending, in order to maintain a sustainable fiscal foundation.

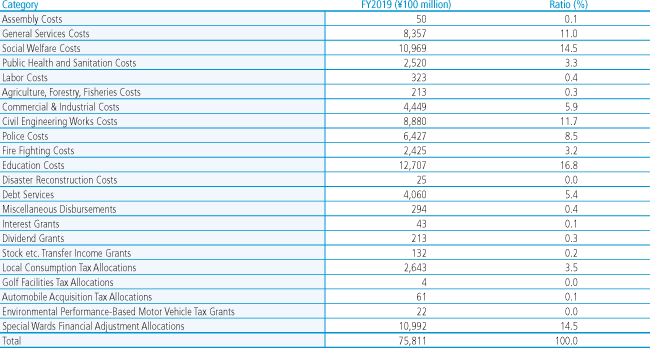

Details of Tokyo Metropolitan Government Expenditure (by Purpose)

Details of Tokyo Metropolitan Government Expenditure (by Type)

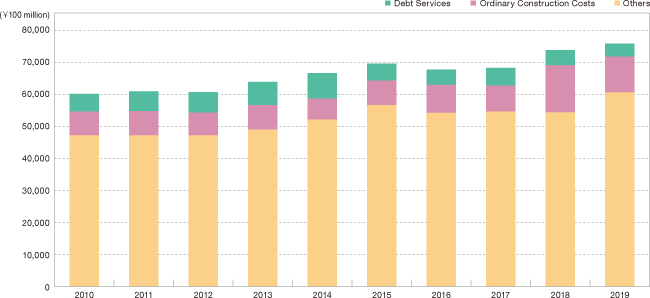

Details and Trends of Tokyo Metropolitan Government Expenditure

Expenditure Breakdown Comparison

Tokyo Metropolitan Government: FY2019 Settlement of Accounts

All Local Governments: FY2019 Settlement of Accounts